What is a Debt Settlement Agreement?

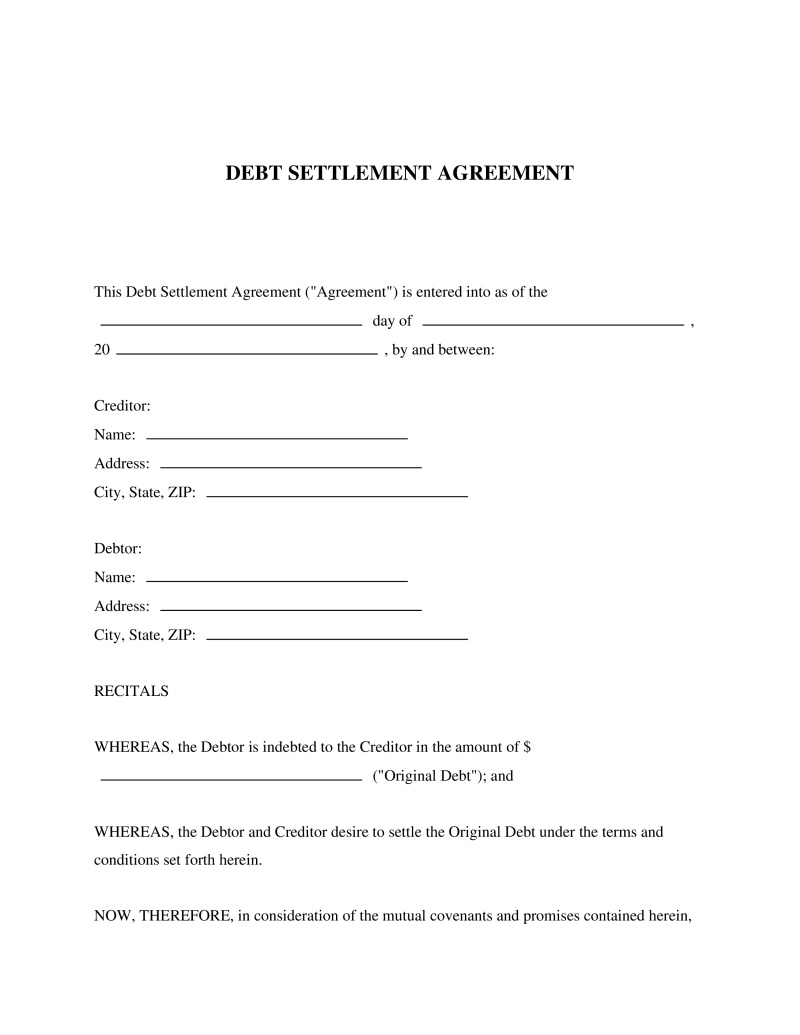

A Debt Settlement Agreement is a legally binding contract between a debtor and a creditor that outlines the terms for resolving an outstanding debt. It's an effective tool often used when a debtor is struggling with debt and wants to avoid bankruptcy or litigation. Such an agreement allows both parties to negotiate and agree on a reduced payment that the debtor can manage, providing an organized and ethical approach on how to get out of debt.

Key Features

Legal Significance

Debt Settlement Agreements provide legal protection to both parties involved. The agreement establishes a new contract that replaces the existing debt obligation. Once signed, the debtor is legally obligated to adhere to the new payment terms, and the creditor cannot pursue the original debt amount or bring additional legal action as long as the debtor meets the agreed-upon payment terms.

Pros & Cons

Pros

Cons

Common Uses

FAQs

About this document

A Debt Settlement Agreement is a legal contract between a debtor and creditor to reduce the total amount owed, outlining repayment terms.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!