What is an Independent Contractor Agreement?

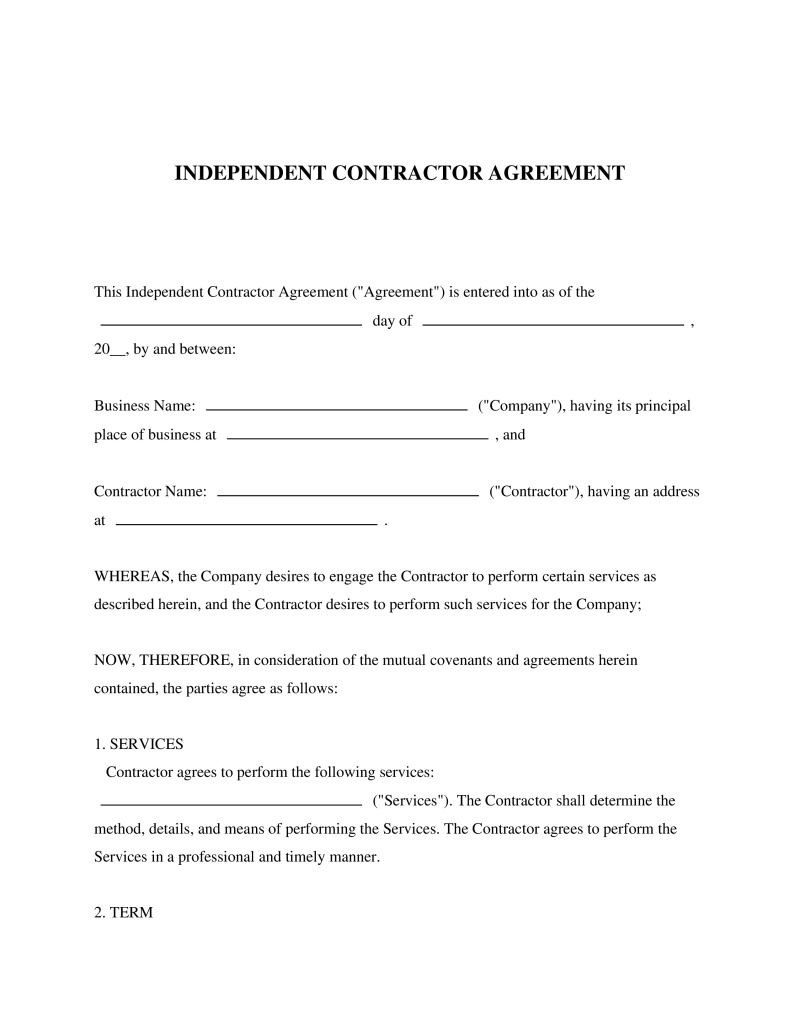

An Independent Contractor Agreement is a legal document that outlines the terms and conditions between a company and a 1099 employee, commonly referred to as an independent contractor. The agreement defines the scope of the project, payment terms, and delineates the contractor's status as an independent entity, not an employee of the company.

This agreement is critical in clearly defining the relationship between the company and the independent contractor. It confirms that the 1099 employee is not entitled to the same benefits as a traditional W-2 employee, highlighting the importance of understanding the dynamics of a "1099 vs W2" employment situation.

When You'll Need This Document

An Independent Contractor Agreement is necessary when a company engages the services of an independent contractor for a specific project or task. This document sets the expectations and legal obligations for both parties and is crucial in instances where the nature of the working relationship could be misinterpreted as "independent contractor vs employee".

Who Benefits from This Form?

Both the company and the 1099 employee benefit from an Independent Contractor Agreement. The company gets the assurance that the contractor cannot claim employee benefits, while the contractor is safeguarded against undue demands beyond the agreed scope of work and payment.

Legal Protection Offered

The Independent Contractor Agreement plays a pivotal role in legally protecting both parties. It delineates the rights and responsibilities of the 1099 employee and the company, preventing potential disputes over payment, work scope, and employment status. It also provides a clear answer to the question, "What are the rules for 1099 employees?"

Realistic Examples Include:

- A graphic designer hired on a project basis to redesign a company's logo.

- A freelance writer contracted to create content for a company's blog.

- A consultant engaged to provide expert advice on a specific business process.

Frequently Asked Questions

About this document

An Independent Contractor Agreement is a legal document that outlines the terms of work between a business and a contractor, clarifying responsibilities, payment, and scope to ensure clear expectations and protect both parties.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!