What is a Business Invoice Template?

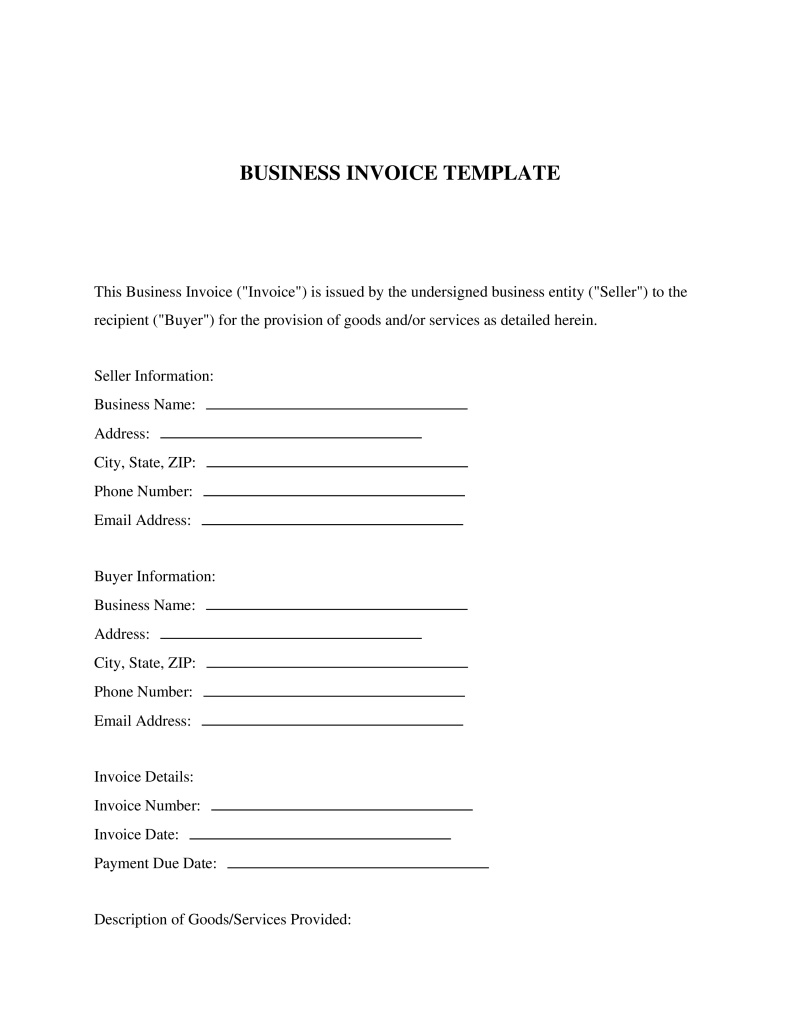

A Business Invoice Template is a professionally designed document that businesses use to bill their clients for goods or services rendered. This crucial business tool not only facilitates smooth transactions but also serves as a legal record of financial transactions between two parties.

When Do You Need a Business Invoice Template?

The need for a Business Invoice Template arises in various situations. It's essential when:

- Requesting payment for goods sold or services provided

- Documenting sales for accounting and tax purposes

- Tracking inventory and sales trends

- Building a professional relationship with clients

Who Can Benefit from Using an Invoice Template?

From small businesses, freelancers, consultants to large corporations, anyone who provides goods or services on a regular or occasional basis can benefit from using a Business Invoice Template. It helps streamline their billing process, maintain accurate financial records, and promote professionalism.

Legal Importance of a Business Invoice Template

A Business Invoice Template carries significant legal weight. It is a formal request for payment and, when duly signed and paid, becomes evidence of a transaction. It can help resolve disputes, protect legal rights, and ensure compliance with tax laws.

Examples of Scenarios for Using a Business Invoice Template

- A freelance graphic designer billing their client for a logo design project

- A small business selling handmade crafts online and requesting payment

- A large corporation billing another business for a bulk order of office supplies

About this document

A business invoice is a financial document issued by a company or independent contractor to clients as an official request for payment and/or legal transaction record.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!