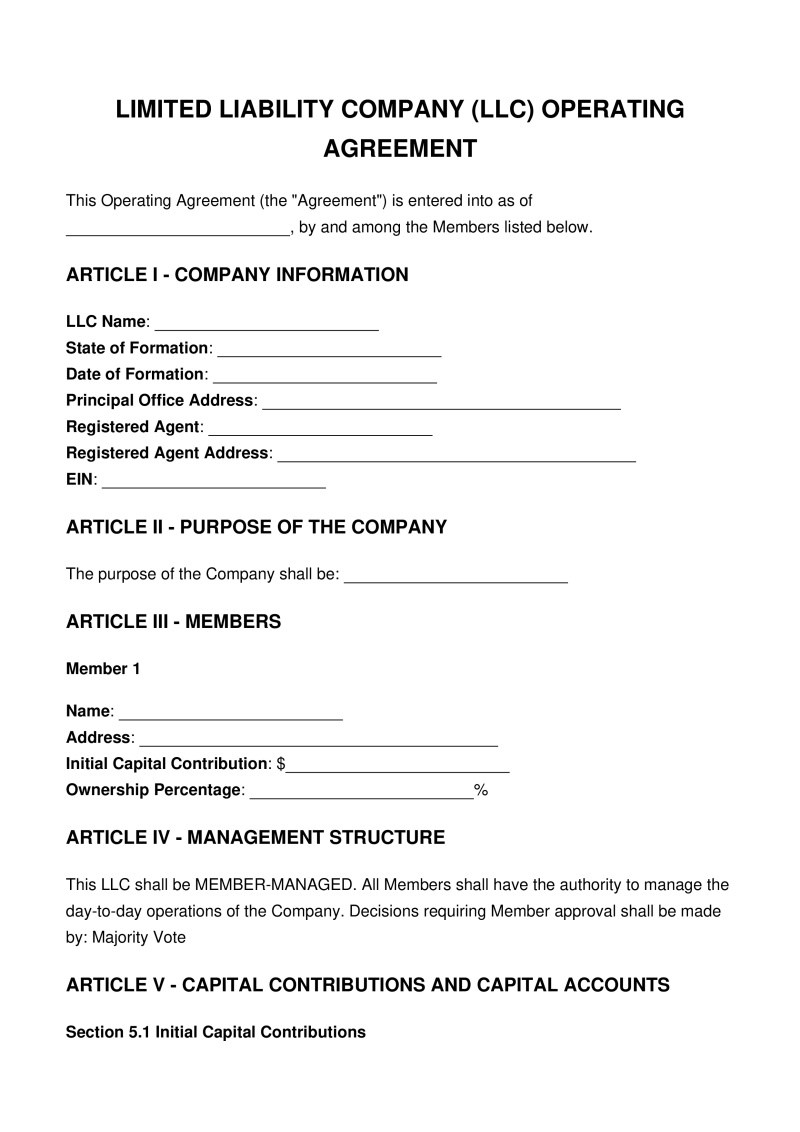

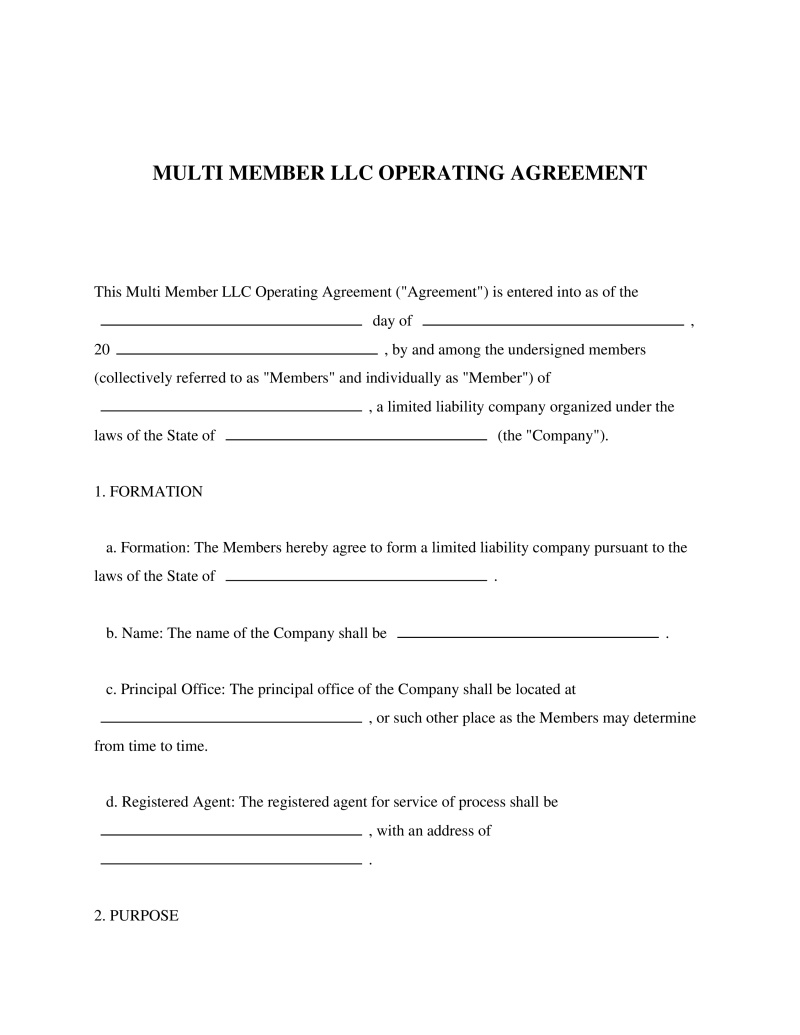

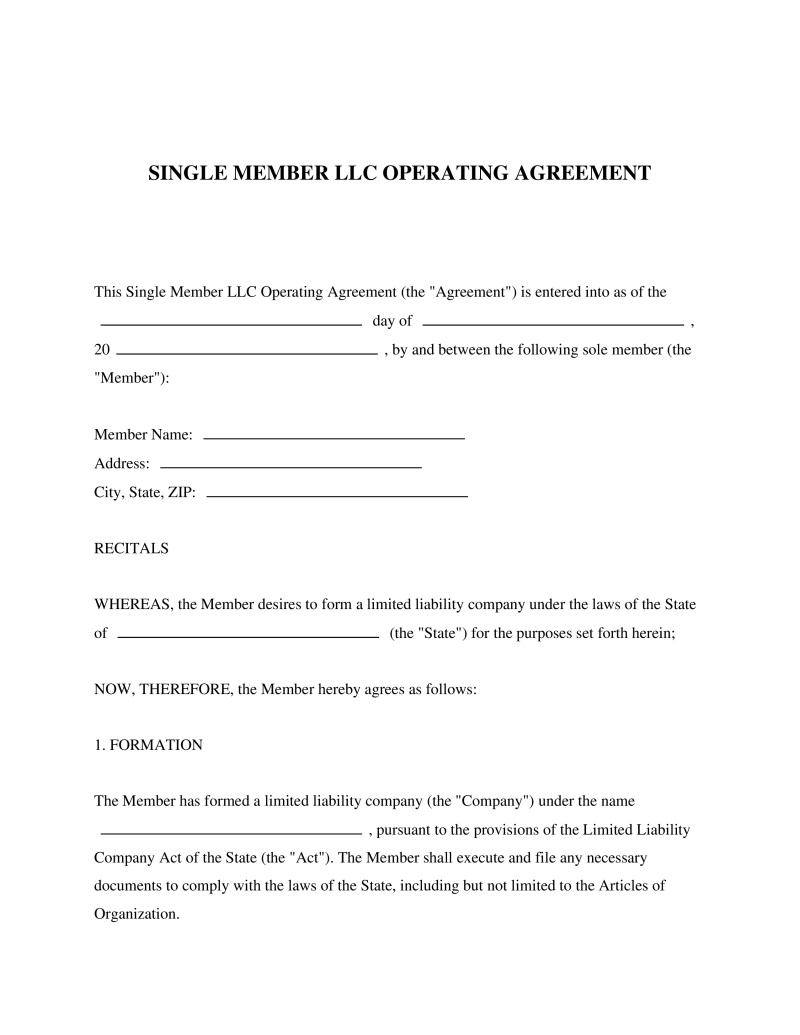

What is an LLC Operating Agreement?

An LLC Operating Agreement is a legal document that outlines the ownership structure, operational procedures, and financial arrangements of a Limited Liability Company (LLC). This critical document helps to establish clear expectations and responsibilities among LLC members, while also providing legal protection by distinguishing the business as a separate entity from its owners. How to create an LLC starts with this foundational document, setting the course for the company's operations and management.

When You'll Need This Document

An LLC Operating Agreement is essential when starting an LLC as it is part of the standard LLC registration process. Here are scenarios that warrant the creation of this document:

- Setting up an LLC for a new business venture

- Transforming a sole proprietorship or partnership into an LLC

- Establishing an LLC to hold real estate or other assets

Ideal Users of a LLC Operating Agreement

Those who benefit most from an LLC Operating Agreement are usually entrepreneurs and small business owners who desire a legal structure which offers personal liability protection. It is also useful for any group of individuals or entities that want to pool resources to start a business, including families, friends, or investment groups.

Legal Protection Offered

A properly drafted LLC Operating Agreement provides numerous legal benefits. Not only does it solidify your business as a separate legal entity, but it also helps to prevent internal disputes by setting clear guidelines for financial and operational decisions. It helps in the establishment of the LLC, serving as evidence of the company's legitimacy in the eyes of banks, creditors, courts, and the IRS.

Realistic Examples of Using an LLC Operating Agreement

- John and Mary, a married couple, decide to start an online retail business. They use an LLC Operating Agreement to specify their respective roles and responsibilites within the company.

- A group of investors want to pool their resources to purchase a commercial property. They form an LLC and use an LLC Operating Agreement to establish how profits and losses will be distributed.

FAQs

About this document

An LLC operating agreement is a legal document outlining the ownership structure, management duties, profit distribution, and operational rules of a Limited Liability Company (LLC). Although typically not required by law, it clarifies members' rights and responsibilities, helping prevent disputes within the LLC.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!