What is a Payment Plan Agreement?

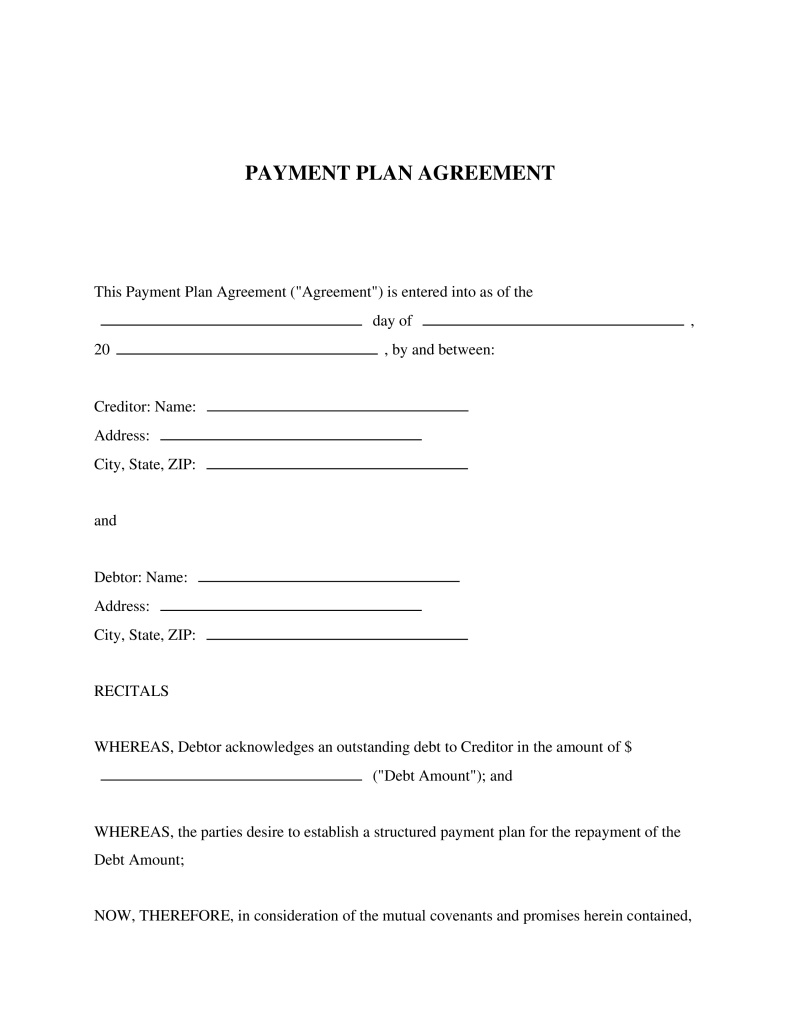

A Payment Plan Agreement, often used when setting up an IRS payment plan, is a legally binding document outlining the terms and conditions of repayment for a debt. It's typically structured to accommodate the debtor's financial situation, detailing the debt amount, duration of the plan, and the payment installments. This agreement serves as a transparent and structured approach to paying off debts while reducing the stress and financial burden on the debtor.

Key Features

Pros & Cons

Pros

Cons

Common Uses

Anyone who owes a debt can benefit from a Payment Plan Agreement. This includes individuals owing money to the IRS, those with outstanding medical bills, student loan borrowers, and credit card users. Businesses that provide services or goods on credit may also use this document to ensure they receive payments on overdue accounts.

About this document

A Payment Plan Agreement outlines the terms for repaying a debt in installments, detailing payment amounts and schedules for both parties.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!