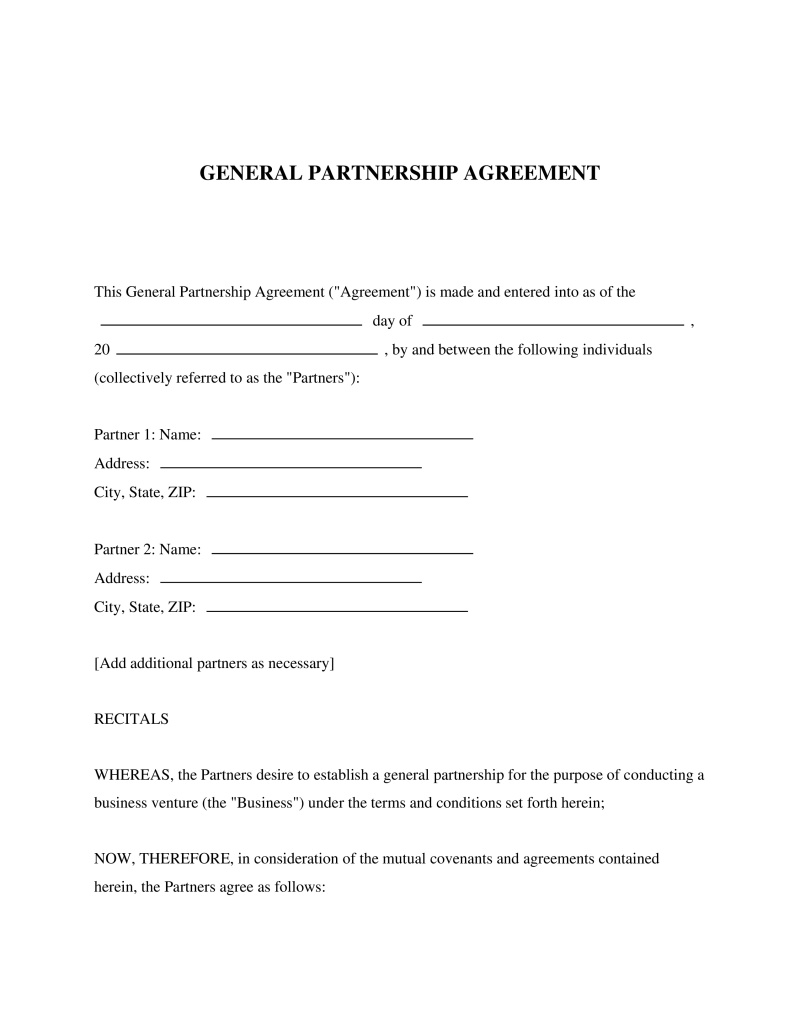

What is a General Partnership Agreement?

A General Partnership Agreement is an essential legal document that outlines the rights, responsibilities, and profit-sharing ratios of each partner in a general partnership. It serves as a vital tool for preventing disputes and providing clarity about the operations of the partnership.

- Defines the roles and responsibilities of each partner

- Sets out the division of profits and losses

- Explains procedures for admitting new partners

- Outlines the decision-making process and conflict resolution strategies

- Details the terms for dissolution of the partnership

Common Circumstances that Require a General Partnership Agreement

A General Partnership Agreement becomes pivotal when two or more individuals decide to establish a business partnership. It is necessary in scenarios such as:

- Setting up a new business as a general partnership

- Adding new partners to an existing partnership

- Changing the structure or terms of an existing partnership

Typical Users

General Partnership Agreements are not limited to one specific type of business or industry. They are commonly used by:

- Small business owners establishing a new partnership

- Existing partnerships that wish to add or change partners

- Entrepreneurs transitioning from a sole proprietorship to a partnership

Key Legal Advantages

Utilizing a General Partnership Agreement can provide various legal benefits:

- Protects partners' personal assets

- Prevents misunderstandings by clarifying partnership terms

- Establishes the pathway for dispute resolution

- Facilitates tax planning and compliance

Examples

- A team of software developers entering into a general partnership to create a new app, using a General Partnership Agreement to outline their respective responsibilities and revenue shares.

- Two entrepreneurs forming a general partnership to open a boutique, with a General Partnership Agreement setting out the terms for decision-making and dispute resolution.

- A group of professionals coming together to form an investment group, utilizing a General Partnership Agreement to establish the investment strategy and distribution of profits.

FAQs

About this document

A General Partnership Agreement outlines the terms of partnership, including roles, responsibilities, and profit-sharing among partners.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!