What is a Limited Partnership Agreement?

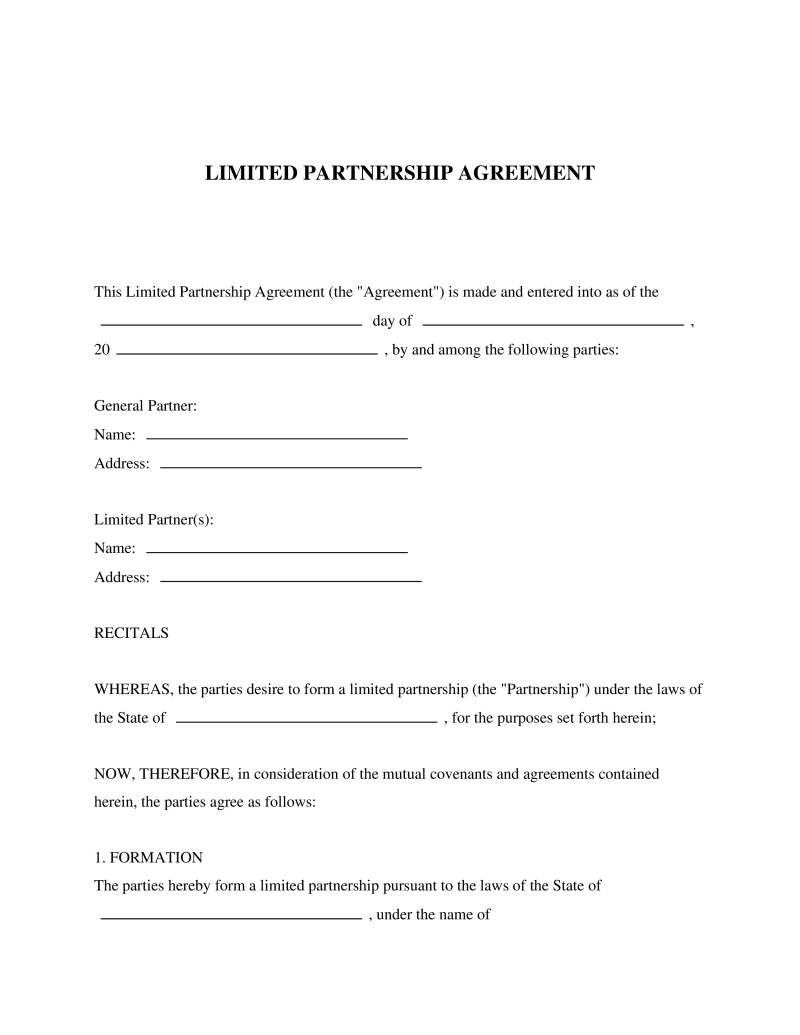

A Limited Partnership Agreement, often referred to as an LP agreement, is a legally binding document that outlines the structure of a limited partnership, the roles and responsibilities of the partners involved, and the distribution of profits and losses. This document is fundamental to operating a limited partnership business structure.

- It defines the rights and duties of limited partners and general partners.

- It outlines the process for making significant business decisions.

- It provides details on how profits and losses are to be distributed among partners.

- It sets the groundwork for dispute resolution.

- It clarifies procedures for adding new partners and outlines exit strategies.

Scenarios That Call for a Limited Partnership Agreement

Limited Partnership Agreements become necessary when initiating a limited partnership business structure. Here are some common situations that call for this form:

- You are starting a venture with a partner who will provide capital while you manage the day-to-day operations.

- You are a silent partner who wishes to invest in a business but doesn't want to participate in its management or bear unlimited liability.

- You are part of a group of investors who want to pool resources for an investment opportunity, with one or more individuals leading the investment.

Common Parties Involved

Those who typically use a Limited Partnership Agreement include:

- General partners: These are the individuals or entities who manage the business and have full personal liability for the partnership’s debts.

- Limited partners: These are the individuals or entities who contribute capital but do not participate in the management of the business. Their liability is typically limited to their investment in the partnership.

Key Legal Benefits

A Limited Partnership Agreement offers several legal protections:

- It helps safeguard the limited liability status of limited partners. Without a proper agreement, courts might treat limited partners as general partners, subjecting them to unlimited liability.

- It reduces disputes among partners by providing a framework for business operations.

- It provides a structured plan for unexpected scenarios such as the death, incapacity, or withdrawal of a partner.

Examples

- A real estate firm where a group of investors (limited partners) pool their resources to purchase property, while the real estate agency (general partner) manages the properties.

- In a film production, where several individuals invest (limited partners) while a director or production company (general partner) is responsible for producing the film.

FAQs About Limited Partnership Agreements

About this document

A Limited Partnership Agreement details the relationship between general and limited partners, outlining roles, responsibilities, and profit-sharing.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!