What is a Personal Guarantee?

A Personal Guarantee is a legal document in which an individual (the guarantor) agrees to be held responsible for the financial obligations of a borrower in the event of default. It is often used in business transactions, where a lender may require a business owner to provide a Personal Guarantee to secure a loan. The primary keywords, "business loan no personal guarantee," refer to loans that do not require such a guarantee.

Key Features

Scenarios That Call for a Personal Guarantee

A Personal Guarantee is often required when a business seeks to secure a loan but lacks the necessary credit history or assets to secure the loan on its own. It's also common in situations where a business owner wishes to separate their personal financial liability from their business, which might be the case when seeking a "business loan without personal guarantee."

Pros

Cons

Common Uses

About this document

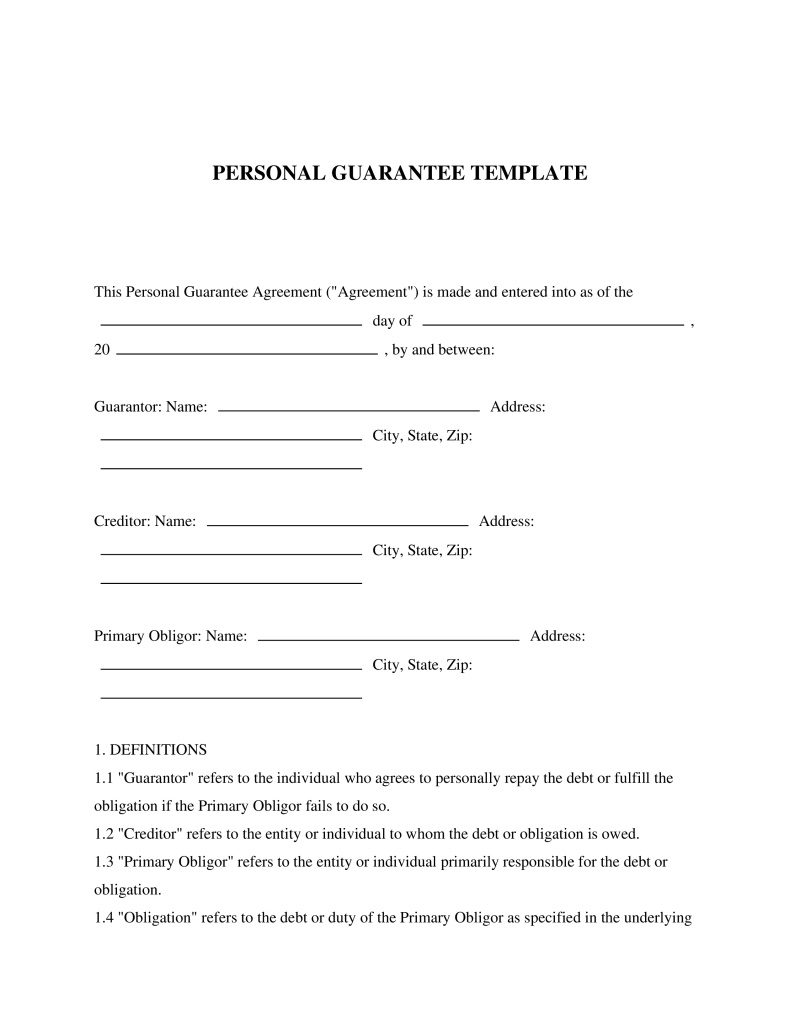

A Personal Guarantee is a legal document where an individual agrees to be responsible for another's debt or obligation if they default.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!