What is a Shareholder Agreement?

A Shareholder Agreement, often referred to as a shareholder contract, is a legal document between the shareholders of a company. It outlines the rights, responsibilities, privileges, and protections of the shareholders. This agreement is used to protect the investments of the shareholders, regulate the management of the company, and define the operational procedures. It can be a highly valuable tool to resolve any disputes that may arise among shareholders or between shareholders and the company’s management. Here are some of its key features:

- Defines the roles and responsibilities of shareholders

- Outlines the rights and obligations of shareholders

- Specifies the process for the sale or transfer of shares

- Details dispute resolution procedures

- Sets out dividend policies and other financial arrangements

When Do You Need a Shareholder Agreement?

While not legally required, a shareholder agreement can be extremely beneficial when launching a new business or when new shareholders join an existing corporation. Here are some specific scenarios that call for a shareholder agreement:

- When a company has more than one shareholder

- When new shareholders acquire a significant amount of stock

- When a minority shareholder needs protection from majority shareholders' decisions

- When there is a need to establish the process for settling potential disputes

Who Benefits from a Shareholder Agreement?

Shareholder agreements are especially beneficial for the shareholders themselves, as they provide clarity about their rights and obligations. This agreement can also benefit the company’s directors and management by providing a framework for corporate governance. Here are some parties typically involved:

- Majority shareholders

- Minority shareholders

- Company directors

- Company management

Legal Protection Offered by a Shareholder Agreement

One of the primary reasons for having a shareholder agreement is the legal protection it provides. It establishes a legal framework for resolving disputes and protects the interest of minority shareholders. Here are some key legal benefits:

- Protects shareholders against unexpected or unfair actions

- Defines the procedures for conflict resolution

- Ensures that shareholders' rights are legally enforceable

Examples of Shareholder Agreement Use Cases

- A startup company with multiple investors may use the agreement to define the terms and conditions of the investment.

- A family-run business may use it to regulate the division of control among family members.

- A company planning an IPO (Initial Public Offering) may use a shareholder agreement to protect the interest of initial investors.

FAQs

How to Create a Shareholder Agreement

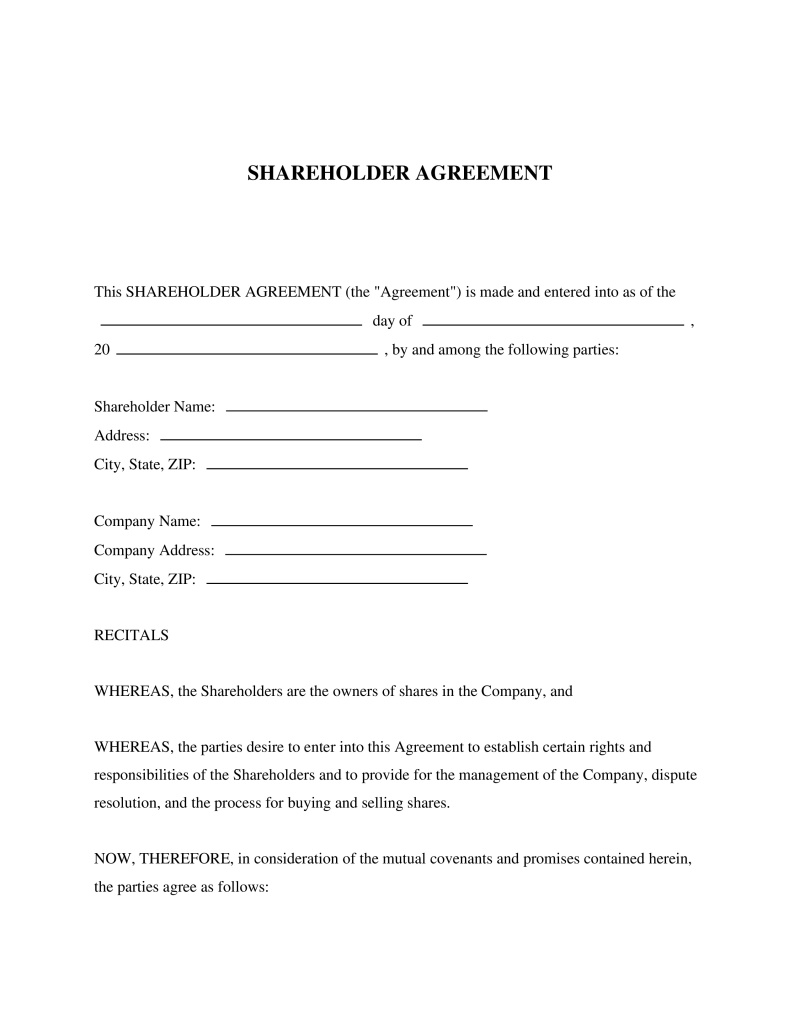

To create a shareholder agreement, often you start with a template that provides a basic format. However, it's essential to customize the agreement to fit the unique circumstances and needs of your company and its shareholders. Here's a basic process:

- Start with a shareholder agreement template that includes the essential sections.

- Customize the template to reflect your company's structure and the shareholders' agreement.

- Consider seeking legal advice to ensure the agreement is comprehensive and legally sound.

- All shareholders must review and sign the agreement for it to be legally binding.

Creating a shareholder agreement is a critical step for many companies. It provides a clear framework for managing the company and protecting shareholders' interests, helping to prevent disputes and ensure smooth operation. Whether you start with a sample shareholder agreement or seek help from a professional, it's essential to create a document that fits your company's unique needs.

About this document

A Shareholder Agreement outlines the rights, responsibilities, and obligations of shareholders in a corporation, ensuring clarity and preventing disputes.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!