What is a Transfer on Death (Beneficiary) Deed Form?

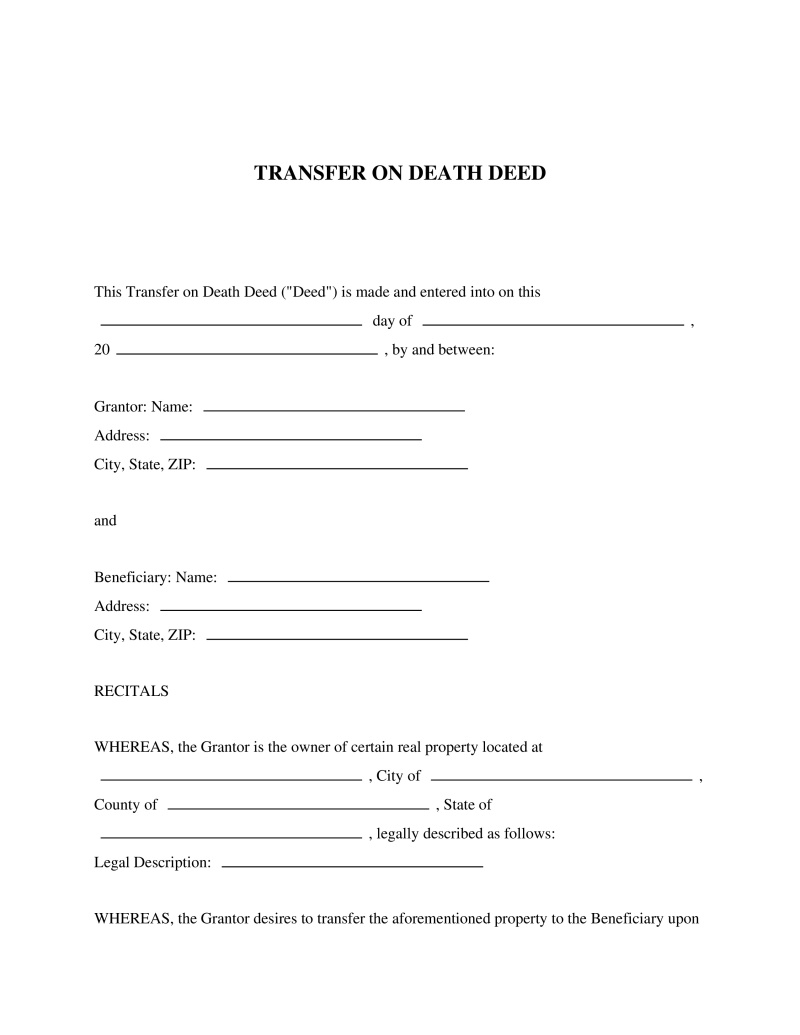

A Transfer on Death (TOD) Deed form, also known as a Beneficiary Deed, is a legal document used to transfer property ownership after the owner's death. The owner retains full control and can revoke or change the deed at any time during their lifetime. Once the owner dies, the property transfers directly to the named beneficiary, bypassing the probate process. Some key features of this deed include:

- Immediate transfer of property upon the owner's death

- Retains the owner's complete control over the property while alive

- Can be revoked or modified at any time by the owner

- Helps avoid the need for probate

Scenarios That Call for a Transfer on Death (Beneficiary) Deed Form

This form is typically used when someone wants to ensure their property is automatically and swiftly transferred to their desired beneficiary upon their death. For example, a parent might use a TOD deed to guarantee their home transfers to their child immediately after their death. Or, a property owner might use it to ensure a cherished friend or organization inherits their property. The TOD deed is also attractive to those wanting to streamline the inheritance process by avoiding probate.

Who Benefits from This Form?

Anyone owning real estate can benefit from using a Transfer on Death Deed form. The following parties commonly find it useful:

- Homeowners wanting to secure their property's future

- Individuals with significant real estate holdings

- Elderly individuals planning their estate

- Parents wanting to pass their property to their children

How This Document Safeguards You

The TOD deed offers several legal benefits. It guarantees immediate transfer of property upon death, helping to avoid the often lengthy and costly probate process. The owner retains full control over the property during their lifetime, and they can revoke or change the TOD deed at any time. This form provides peace of mind that the property will quickly and smoothly transfer to the desired party after the owner's death.

Examples of Transfer on Death (Beneficiary) Deed Form Use

- A single parent uses a TOD deed to ensure their home transfers directly to their only child upon their death.

- An elderly woman uses a TOD deed to leave her vacation home to her favorite nonprofit organization.

- A businessman uses a TOD deed to secure the future of his significant real estate holdings, ensuring they transfer swiftly to his heirs.

Applicable Laws and Regulations

While TOD deeds are widely accepted, they're not recognized in all states. For instance, in "transfer on death deed Texas", the state allows for such deeds under its statutory laws. However, each state has specific requirements and restrictions for TOD deeds. Always consult with a knowledgeable attorney or real estate professional in your state before proceeding with a TOD deed.

Frequently Asked Questions

About this document

A Transfer on Death Deed allows property owners to designate beneficiaries, enabling direct transfer of real estate upon their death.

This document utilizes our advanced PassTheBar AI technology, ensuring bar-exam precision and comprehensive legal coverage.

This document is designed to comply with the laws of all 50 states.

Community Discussion

Share your experience and help others

Legal Notice: Comments are personal opinions and do not constitute legal advice. Always consult a qualified attorney for matters specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!